-

Read more

Read moreCompanies zealously guard their trade secrets and other information that gives them a competitive edge. And as we’ve covered in prior posts, companies often resort to the courts to protect this kind of information.

Recently, a media company filed a lawsuit seeking to use trade secret protections to recover something very public—a reporter’s Twitter account.

-

Read more

Read moreThis post deals with two related protections that state laws and companies provide for directors and officers—indemnification and advancement. Corporations usually commit to indemnify officers and directors (and sometimes employees) when, because of their connection to the company, they are pulled into legal proceedings. Corporation also usually agree to advancement - paying legal fees and costs in advance of a final determination about the individual’s right to indemnification - so that officers and directors don’t have to foot the legal bills themselves while such a matter is going on.

-

Read more

Read moreOn May 29, Roseanne Barr posted a tweet comparing former Obama adviser Valerie Jarrett to an ape. ABC’s reaction was swift and decisive: it fired Barr and cancelled her show.

ABC’s decision led to pontification from various pundits and Twitter personalities arguing that Barr’s “humor” was somehow “free speech” protected by the First Amendment.

But even if Barr was exercising free speech when she posted her tweets, that has no bearing on ABC’s lawful right to fire her. ABC is a private employer, not the government, so the First Amendment did not prevent it from taking action based on employee speech.

-

Read more

Read moreCompanies and individuals frequently enter into arbitration agreements requiring that claims be brought before a private arbitrator, rather than a judge and jury. Arbitration has various benefits: it can provide quicker resolutions, reduced costs, the right to participate in the selection of the arbitrator, and arbitral expertise. In addition, some parties prefer arbitration because it offers a cloak of confidentiality that does not exist in the state and federal courts.

-

Read more

Read morePhishing. Spoofing.

These words may sound silly, but for employers, they are anything but.

Phishing is the attempt to obtain sensitive electronic information—such as usernames, passwords, or financial information—under false pretenses. Often, when bad actors engage in phishing, they use email spoofing—sending emails that appear legitimate but are anything but. These emails can dupe users into disclosing confidential personal or company information.

-

Read more

Read moreWhen an employer changes its contract with an employee, the change should be communicated clearly—and preferably, in writing. Otherwise, the employer may be at risk of finding that the old terms still control.

For example, last week in Balding v. Sunbelt Steel Texas, Inc., No. 16-4095 (10th Cir. Mar. 13, 2018), a federal court of appeals ruled that an employer had to go to trial over a salesman’s claim for unpaid commissions.

-

Read more

Read moreTell the Securities and Exchange Commission (SEC). That’s the message the United States Supreme Court sent to whistleblowers with its decision yesterday in Digital Realty Trust, Inc. v. Somers.

As we previously covered here, the Digital Realty case involved a key issue under the Dodd-Frank Act’s anti-retaliation provision: does the provision apply to a whistleblower who reported internally, but did not provide information to the SEC?

-

Read more

Read moreCompanies want to attract talented leadership, and protections for officers and directors against lawsuits can be part of the total package.

This is one reason why many businesses incorporate in Delaware—Delaware law provides significant assistance to officers and directors who are named in legal proceedings connected to their corporate role. Delaware courts don’t hesitate to uphold this protection when circumstances warrant. And in Horne v. OptimisCorp, the Delaware courts again vindicated an officer’s broad rights to indemnification under Delaware law.

-

Read more

Read moreWhen the calendar flips from December to January, it’s a good time to take stock of what to expect over the next 12 months. Here are four major issues in employment law that we’ll be watching in 2018:

-

Read more

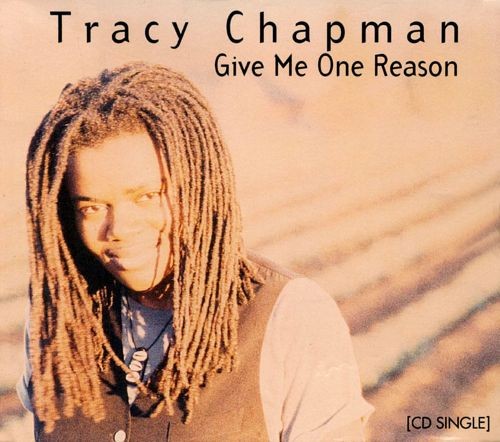

Read moreTracy Chapman famously sang about needing “one reason to stay here.” But when severance is involved, employees may look for one reason to leave—one “Good Reason.”

While Ms. Chapman didn’t sing about them, many employment contracts include a “Good Reason” clause, which allows the employee to resign and still receive severance if certain conditions are met.

For example, many Good Reason clauses provide that an employee can receive severance upon resignation, so long as the employee has suffered from a reduction in salary or benefits, diminution of duties or responsibilities, or due to a forced relocation. In some cases, these Good Reason clauses only apply when an employee resigns following a change in control of the employer (for example, a merger or acquisition).

As the regulatory and business environments in which our clients operate grow increasingly complex, we identify and offer perspectives on significant legal developments affecting businesses, organizations, and individuals. Each post aims to address timely issues and trends by evaluating impactful decisions, sharing observations of key enforcement changes, or distilling best practices drawn from experience. InsightZS also features personal interest pieces about the impact of our legal work in our communities and about associate life at Zuckerman Spaeder.

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.

Contributing Editors

John J. Connolly

Partner

Email | +1 410.949.1149

Andrew N. Goldfarb

Partner

Email | +1 202.778.1822

Sara Alpert Lawson

Partner

Email | +1 410.949.1181

Nicholas M. DiCarlo

Associate

Email | +1 202.778.1835