The Inbox – It’s Electric

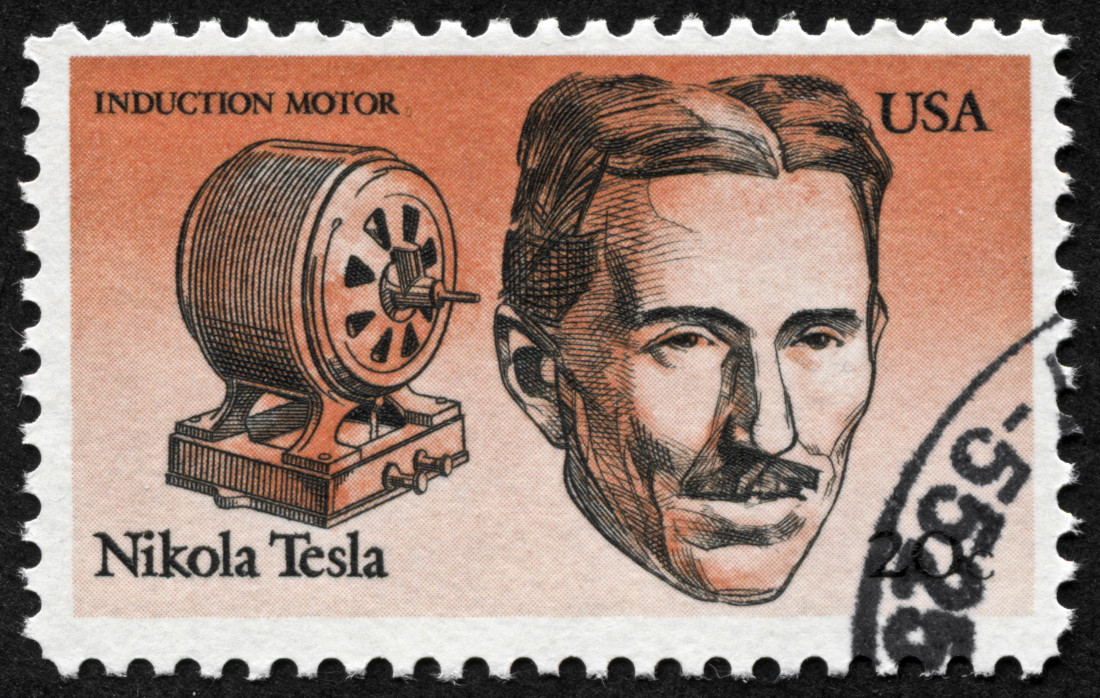

The famous scientist Nikola Tesla was prolific not only in his scientific writings and experiments, but he has also become quite the posthumous eponym. From 80s rock bands to electric car manufacturers, the Tesla name continues to find its way into the headlines. Nikola’s more recent namesake, Tesla Motors (named for Mr. Tesla’s patented AC induction motor), was allegedly the target of a former disgruntled employee, Nima Kalbasi. Prosecutors say that Mr. Kalbasi, a Canadian national and mechanical engineer, hacked the company’s servers. According to The Washington Times, Mr. Kalbasi was terminated on December 3rd of last year, but not before he was able to ferret out his boss’s email credentials. For the next few weeks, according to allegations in Mr. Kalbasi’s criminal case, Mr. Kalbasi repeatedly accessed Tesla’s corporate server to retrieve employee reviews and at least one consumer complaint against the company, which he published online along with some other disparaging commentary. Ironically, Mr. Kalbasi allegedly used in his computer hacking the wireless technology that many credit to Mr. Tesla himself.

A class of investors sued battery maker A123 for failing to disclose that Fisker Automotive – its primary customer – was enduring financial difficulties and heading for bankruptcy. As Fisker suffered setbacks and was eventually acquired by Chinese automotive parts maker, WanXiang last year, some investors asserted that A123 executives failed to disclose its true financial position, thus fraudulently inflating A123’s stock price. According to Law 360, a Manhattan federal judge dismissed the shareholder claims, stating that the plaintiffs failed to prove that the A123 execs made false or misleading statements. While Fisker’s technology will find new life under its new parent organization, it seems A123 is regenerating as well. Following A123’s bankruptcy proceedings, WanXiang’s influx of cash recharged A123’s own fiscal batteries.

Ignorance of the law is no excuse, and the SEC didn’t cut a fledgling company much slack when it came to its reporting obligations. The SEC recently settled charges against nutritional supplement maker, MusclePharm Corp., with under-reporting executive compensation that came in the form of perqs like golf memberships, meals and clothes. Three executives and the chair of the audit committee agreed to pay $910,000 in penalties to settle the charges. According to the Denver Business Journal, SEC Enforcement Head Andrew Ceresney stated that executive compensation is material to investors and underscored the importance of proper disclosures in public filings. Ceresney also stated that the audit chairman “subjected himself to liability when he substituted his wrong interpretation of SEC rules for the views of experts the company had hired, resulting in an incorrect disclosure.”

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.

As the regulatory and business environments in which our clients operate grow increasingly complex, we identify and offer perspectives on significant legal developments affecting businesses, organizations, and individuals. Each post aims to address timely issues and trends by evaluating impactful decisions, sharing observations of key enforcement changes, or distilling best practices drawn from experience. InsightZS also features personal interest pieces about the impact of our legal work in our communities and about associate life at Zuckerman Spaeder.

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.