Show posts for: Whistleblowers

-

Read more

There’s often a fine line between being a bona fide whistleblower and being just an angry plaintiff suing for wrongful termination. The plaintiff’s allegations of whistleblowing conduct can often be very similar to the conduct that gave rise to him or her being fired – setting up something of a Rorschach blot test for the court that is trying to figure out what’s really going on.

That’s the position doctor Mark Fahlen found himself in. Doctor Fahlen was fired by his employer, a group of doctors working at a hospital in California. The doctor said he was fired, in part, because he complained – as a whistleblower – about nurses in the hospital failing to provide adequate care for his patients because they failed to follow his instructions. The group of doctors fired Fahlen after the hospital revoked his privileges (apparently a necessary part of being a member of the group) because it said Fahlen had angry fights with those same nurses – and, therefore, he was fired because he wasn’t a suitable employee. So, essentially the same factual allegations could be whistleblowing or a basis for termination.

-

Read more

Read moreHere at the Suits by Suits Worldwide Operations Center, weather continues to have us flummoxed, vexed, and annoyed: even though a famous Pennsylvania rodent discerned that we would have six more weeks of our brutal winter, we’ve had a pleasant warm spell that is about to come to a crushing end due to a storm front that goes by the curious name of "Texas Hooker" (we did not make that up). And we’re about to be plunged back into the depths of the polar vortex yet again – although our earlier bouts with the grim chill may have wiped out our area’s growing population of stink bugs.

In any event, we always take shelter from the storms, the cold, and the heat by digging into our Inbox of interesting developments in executive employment disputes and the issues that surround them, including:

- The Securities and Exchange Commission has filed an amicus brief in the Second Circuit, arguing that its interpretation of a “whistleblower” under Dodd-Frank – essentially an employee who reports wrongdoing either internally or to the SEC – should be followed. We’ve covered this case, Liu v. Siemens, before, for an earlier ruling holding that Dodd-Frank’s whistleblower protections don’t apply overseas.

- Staying with the whistleblower theme for a minute: government contractor Kellogg Brown & Root is being attacked by a whistleblower, who has complained to the SEC and the Justice Department that employees are forced to sign confidentiality agreements that prevent them from ever disclosing allegations of wrongdoing. This one could be interesting…

- Auto retailer Carmax is defending the arbitration clause in its employment agreement in a California appellate court, urging it to reject an employee’s argument that the clause is illusory because Carmax reserved the right to amend it at any time.

- The bankruptcy trustee for real estate company Grubb & Ellis is trying to claw back $650,000 from a former executive, alleging the payments in stock and paid time off were fraudulent.

- Finally, while we write a lot about non-compete agreements between executives and employers generally, we rarely see them between divorcing spouses – but a California court of appeal ruled on just such an issue this week. The court held that a judge’s order prohibiting one spouse from working in the same field – the rum importing business – as the other spouse didn’t violate California’s general ban on non-compete agreements because the order was an order, and not an agreement. It remanded the case, however, finding its five-year, worldwide ban on the one spouse getting into the rum importing business was overbroad.

-

Read more

Read moreLove is in the air as couples celebrate Valentine’s Day with chocolates, flowers and romantic dinners. But there’s no love lost between some employers and their executives, as this week’s Inbox shows:

- BLR.com reports on a fascinating case involving Bruce Kirby, former CEO of Frontier Medex. In a lawsuit in Maryland federal district court, Kirby alleged that he was the beneficiary of a change-in-control severance plan and that Frontier kept him on for over a year solely for the purpose of defeating his severance benefits, even though it told him it was going to terminate him before that. The court ruled that he was not contractually entitled to severance, but could pursue a claim that Frontier interfered with his benefits, violating ERISA.

- Retired Ohio Bureau of Workers’ Compensation attorney Joe Sommer is asking the Ohio Supreme Court to review a decision that limited the application of whistleblower protections in that state. He believes that the Franklin County Court of Appeals overly limited whistleblower claims when it ruled that an employee had to report criminal conduct in order to be protected from retaliation.

- According to Benefits Pro, the EEOC “slammed” CVS over its severance deals in a lawsuit against the company in Illinois federal court. The lawsuit alleges that CVS required employees to sign severance agreements with five pages of small print, some of which bargained away the employees’ rights to communicate to agencies about practices that violated the law. CVS says that nothing in those agreements barred employees from going to the EEOC with complaints.

- Hook ‘em, Mack! Former Texas football coach Mack Brown, who resigned after this season, did get some love from his employer, as the San Francisco Chronicle reports that he will receive $2.75 million that he was owed under his contract in event of termination. He will also get a cushy $500k job this year as special assistant to the president for athletics.

- John O’Brien of Legal News Line reports that a California appellate court will allow a whistleblower’s claim of retaliation under the False Claims Act to be heard in state court. Dr. Scott Driscoll, a radiologist, claims that he was fired for complaining that his employer was committing Medicare fraud. When the employer sued him in state court, Driscoll counterclaimed for FCA violations. The California court decided that it had jurisdiction to hear the claim, rejecting the employer’s argument that federal courts have exclusive jurisdiction over FCA retaliation claims.

-

Read more

For those of us who follow whistleblower law, Wednesday was a big day – and a good one for employers. In two separate federal appellate decisions, courts affirmed the dismissal of whistleblower actions based on very different issues. For potential whistleblowers and employers alike, the decisions demonstrate yet again the importance of the particular requirements and scope of the law that a whistleblower relies on to support his claim.

The first decision, Villanueva v. Department of Labor, No. 12-60122 (5th Cir. Feb. 12, 2014), comes to us from the Fifth Circuit. It involves William Villanueva, a Colombian national who worked for a Colombian affiliate of Core Labs, a Netherlands company whose stock is publicly traded in the U.S. Villanueva claimed that he blew the whistle on a transfer-pricing scheme by his employer to reduce its Colombian tax burden, and that his employer passed him over for a pay raise and fired him in retaliation for his whistleblowing.

-

Read more

Read moreThe federal courts are drawing a clear battle line over the disclosures that an employee must make before bringing a whistleblower retaliation claim under the Dodd-Frank Act of 2010. Leading the charge on the one side is the Fifth Circuit, which held in Asadi v. GE Energy (LLC) that a fired employee can’t bring a Dodd-Frank retaliation claim unless he reported corporate misconduct to the SEC prior to his firing. On the other side, the SEC and judges in New York, Connecticut, and Tennessee are massing in support of allowing a plaintiff to bring a retaliation claim even if he only disclosed the misconduct internally prior to firing.

Two months ago, Judge Richard Stearns of the U.S. District Court for the District of Massachusetts joined the SEC’s side of the battle. He ruled that Richard Ellington could pursue a Dodd-Frank retaliation claim against his former employer, New England Investment & Retirement Group, Inc. (NEINV), and his boss, Giacoumakis, even though Ellington only reported concerns about wrongdoing to NEINV’s compliance officer prior to his termination, and did not go to the SEC until after he was fired. Ellington v. Giacoumakis, No. 13-11791-RGS (D. Mass. Oct. 16, 2013).

-

Read more

Here at Suits by Suits, we are thankful that the news about executive-employer disputes keeps flowing like gravy. This past month, we focused a lot of attention on non-compete agreements, many of which met the same fate as an unpardoned turkey. On a day as cold as chilled cranberry sauce, we sent a live correspondent to cover the oral argument in Lawson v. FMR LLC, in which the Supreme Court will decide whether employees of privately-held contractors of public companies have viable Sarbanes-Oxley claims. Finally, as per our holiday tradition, we recapped the history of Thanksgiving, in a post as entertaining as the most memorable Cowboys loss.

- Skunks, Conquistadores, and Killer Balloons: Why Thanksgiving Is the Best Tuesday (or Possibly Thursday) of the Year

November 27, 2013 | P. Andrew Torrez - Texas Strictly Construes Application of Mandatory Arbitration Clause Despite Superseding Agreement with No Such Clause

November 25, 2013 | P. Andrew Torrez - Will Fiduciary Liability Insurance Cover Severance Agreement Payments If The Company Can’t Make Them?

November 22, 2013 | William A. Schreiner, Jr. - Upcoming Suits by Suits Webinar: Whistleblower Watch

November 21, 2013 | Jason M. Knott - It Was The Added "0" That Did It -- Among Other Things

November 19, 2013 | William A. Schreiner, Jr. - I Can't Quit You! - Why Quitting a Company May Not Mean Quitting Fiduciary Duties in Virginia

November 14, 2013 | Ellen D. Marcus - Argument Recap: Five Takeaways from Lawson v. FMR LLC

November 13, 2013 | Jason M. Knott - What I Don't Know About Your Non-Compete Can't Hurt Me, Right?

November 11, 2013 | Ellen D. Marcus - Argument Preview: What to Look For in Lawson v. FMR LLC

November 7, 2013 | Jason M. Knott - “Man Bites Dog” in the Fourth Circuit: Court Reverses Arbitrator’s Award and Enforces Release

November 6, 2013 | Jason M. Knott - The Basics: Dodd-Frank vs. Sarbanes-Oxley Whistleblower Law

November 5, 2013 | Jason M. Knott

If you are interested in more information about legal issues involving executives and their employers, on December 10, 2013, Zuckerman Spaeder LLP partners and Suits by Suits contributing editors Ellen D. Marcus and Jason M. Knott will present a webinar titled “Whistleblower Watch: Big Issues in the Latest Whistleblower Cases Under Dodd-Frank, Sarbanes-Oxley, and the Internal Revenue Code.” In the session, Ms. Marcus and Mr. Knott will discuss the basics of these whistleblower and anti-retaliation provisions and address new developments in the law, including the Sarbanes-Oxley case currently pending before the U.S. Supreme Court. To register, click here.

- Skunks, Conquistadores, and Killer Balloons: Why Thanksgiving Is the Best Tuesday (or Possibly Thursday) of the Year

-

Read more

On December 10, 2013, Suits by Suits contributing editors Ellen D. Marcus and Jason M. Knott will present a live webinar titled “Whistleblower Watch: Big Issues in the Latest Whistleblower Cases Under Dodd-Frank, Sarbanes-Oxley, and the Internal Revenue Code.” During the webinar, Ms. Marcus and Mr. Knott will discuss the whistleblower and anti-retaliation provisions of the Dodd-Frank and Sarbanes-Oxley Acts, the Internal Revenue Code, and other federal statutes. Their presentation will address the types of businesses and conduct that can be targeted by whistleblowers, the procedures that whistleblowers must follow to pursue and preserve a claim, the remedies available to whistleblowers, and more. Ms. Marcus and Mr. Knott will also examine the pressing issues under these laws that are being debated in the courts. This includes contradictory decisions about whether the Sarbanes-Oxley Act’s whistleblower provision covers employees of privately-held companies, such as investment advisers—an issue that is currently before the U.S. Supreme Court in the case of Lawson v. FMR LLC, which we have previously covered in various posts. To register for the webinar, click here.

-

Read more

On Tuesday, the Supreme Court heard oral argument in Lawson v. FMR LLC. As we explained in this post, Lawson presents the question of whether Sarbanes-Oxley’s whistleblower anti-retaliation provision (Section 806 of Sarbanes-Oxley, codified at 18 U.S.C. § 1514A) shields employees of privately-held contractors of public companies such as the plaintiffs, who are employees of investment advisers for Fidelity mutual funds. We editors of Suits by Suits don’t often get the chance to report live on the cases we cover, but an argument at One First Street was too tempting to pass up, even on a blustery Washington day. Here are five major takeaways that we drew from the argument (with the caveat that reading the tea leaves from an oral argument is always a difficult proposition):

1. The Court is uncomfortable with the scope of potential Sarbanes-Oxley claims that would result from the Fidelity employees’ interpretation of the statute.

A number of Justices pressed Eric Schnapper, who argued for the Fidelity employees, and Nicole Saharsky, arguing for the United States in support of the employees, as to how the Court could limit the reach of the statute if it holds that Sarbanes-Oxley allows employees of private companies to bring whistleblower retaliation claims. Justice Breyer posed a hypothetical involving an employee of a privately-held gardening company who reports on mail fraud by his employer, is fired, and then brings a whistleblower anti-retaliation claim, arguing that he is covered by Sarbanes-Oxley because his company has gardening contracts with public companies. Schnapper argued that the statute as written would cover the gardener, but the Justices were less convinced that Congress intended this kind of reach for Sarbanes-Oxley. Justice Breyer even commented that the fear of expanding the statute to cover “any fraud by any gardener, any cook, anybody that had one employee in the entire United States” was the “strongest argument” against the Fidelity employees’ position.

-

Read more

Twitter’s founders are cashing in on Wall Street, and journalists are piggybacking on the news with articles like this one, which recaps 10 “surprising superstars” of the social network. No, Suits by Suits didn’t make the cut, but you can still follow us at @suitsbysuits, where we’ll bring you 140-word tweets about news related to executive-employer disputes. These are the kinds of stories we track:

- The Texas Supreme Court heard argument this week in Exxon Mobil’s dispute with former executive William Drennen. Jeremy Heallen of Law360 (subscription required), wrote that after Drennen retired from Exxon (@exxonmobil) and went to work for competitor Hess, Exxon claimed that he had forfeited his restricted stock under a “detrimental-activity provision” in his incentive plan. Exxon is seeking reversal of the lower court’s holding that the forfeiture violated Texas law, which disfavors “unreasonable” noncompetition agreements.

- AIG has settled a $274 million dispute with former real estate executive Kevin Fitzpatrick, reported (@nateraymond) Nate Raymond of Reuters. The terms are confidential, but Fitzpatrick’s lawyer says that he is “very happy.” Given the potential dollar amounts between $0 and $274 million, it’s easy to guess why.

- Rachel Louise Ensign of the Wall Street Journal (@RachelEnsignWSJ) (subscription required) covered a developing trend this week: more whistleblowers are coming from corporate compliance departments. As one example, Ensign described Meng-Lin Liu’s case against Siemens AG, which we covered here. The possibility of lucrative awards under the Dodd-Frank Act’s whistleblower program may be sparking the trend, although as Ensign points out, compliance officers are subject to additional restrictions under that program.

- In other whistleblower news, the Senate approved a bill to prohibit companies from retaliating against whistleblowers who report violations of the antitrust laws. Jennifer Koons of Main Justice (@jenkoons) said that the bill passed with bipartisan support. “Bipartisan” – does anyone still remember that concept?

- Newscaster Larry Conners is still trying to get back on television, despite a prior ruling that his noncompete agreement prohibited him from working for other TV stations in the St. Louis market for a year. Conners’s attorney asked the judge to modify that ruling, which restricted Conners to radio work, wrote (@STLSherpa) Joe Holloman of the St. Louis Times-Dispatch. We’ve previously examined Conners’s case here and here.

-

Read more

Read moreOn Tuesday, November 12, the Supreme Court will hear argument in the most-watched case of this Term (at least for those of us who edit this blog). The case, Lawson v. FMR LLC, presents the question of whether an employee of a privately-held contractor of a public company can bring a whistleblower retaliation claim against his or her employer under the Sarbanes-Oxley Act of 2002. The plaintiffs in the case, and the parties who have appealed to the Supreme Court, are Jackie Lawson and Jonathan Zang.

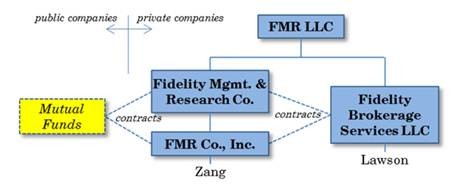

In their lawsuit, Lawson and Zang claim that their employers – a group of privately-owned Fidelity subsidiaries that serve as “investment advisers” to publicly-held Fidelity mutual funds – retaliated against them for raising concerns about fraud. Here’s a handy chart from Fidelity’s brief that illustrates the relationship between the parties:

The First Circuit dismissed Lawson and Zang's claims, holding that Sarbanes-Oxley’s anti-retaliation provision only protects employees of public companies. Because Lawson and Zang worked on the blue side of the chart, and not the yellow side, they couldn’t bring a claim for retaliation. (The mutual funds on the yellow side have no employees; they do their business through their contractors on the blue side.)

What do Lawson and Zang argue?

The parties spend a lot of time parsing the language of the Sarbanes-Oxley anti-retaliation provision (18 U.S.C. § 1514A). In their opening and reply briefs, Lawson and Zang argue that the plain text of the law shows that Congress intended to shield employees of contractors of public companies from retaliation for reporting corporate misconduct. If Congress didn’t mean to protect those employees, they say, it wouldn’t have prohibited retaliation by “any officer, employee, contractor, subcontractor, or agent” of “such [public] company.” Under Fidelity’s reading of this provision, the language about contractors would only come into play if a contractor retaliated against a public company employee, and because that doesn’t happen in the real world, the use of the term “contractor [or] subcontractor” would be meaningless.

As the regulatory and business environments in which our clients operate grow increasingly complex, we identify and offer perspectives on significant legal developments affecting businesses, organizations, and individuals. Each post aims to address timely issues and trends by evaluating impactful decisions, sharing observations of key enforcement changes, or distilling best practices drawn from experience. InsightZS also features personal interest pieces about the impact of our legal work in our communities and about associate life at Zuckerman Spaeder.

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.

Contributing Editors

John J. Connolly

Partner

Email | +1 410.949.1149

Andrew N. Goldfarb

Partner

Email | +1 202.778.1822

Sara Alpert Lawson

Partner

Email | +1 410.949.1181

Nicholas M. DiCarlo

Associate

Email | +1 202.778.1835