Show posts for: The Inbox

-

Read more

Read moreIt is the norm for high-achieving employees to strive for and tout their successes. Recently, however, one person’s novel reaction to failure—his own termination—may show a future employer as much about his character as any of his considerable accomplishments.

Sree Sreenivasan was plucked from Columbia’s School of Journalism a few years ago to become the New York Metropolitan Museum of Art’s chief digital officer. According to Quartz, Mr. Sreenivasan brought the famed museum into the digital age through inventive social outreach efforts and a revamped, mobile-friendly website.

-

Read more

Read moreAs employees of the New York-based Chobani yogurt plant filed into work last Tuesday, they were met with sealed, white envelopes containing a sweet financial surprise.

Little did they know, the owner and CEO, Hamdi Ulukaya, had been working with the human resources consulting firm, Mercer, to hatch a plan to transfer 10 percent of his stock in the company to roughly 2,000 full-time employees.

-

Read more

Read moreThe U.S. Equal Employment Opportunity Commission scored a victory last week against PMT Corp., a Minnesota-based medical device and equipment manufacturer. According to the commission’s complaint filed nearly two years ago, PMT Corp. engaged in systematic discriminatory hiring practices by refusing to hire women and individuals over the age of 40 in violation of Title VII and the Age Discrimination in Employment Act. According to Law 360, PMT agreed to settle the suit for $1.02 million payable to a class of applicants and a former PMT Human Resources professional who brought the company’s hiring practices to the EEOC’s attention.

-

Read more

Read moreAs the United States gears up for next year’s presidential election, it’s always fun to check in with PolitiFact’s Truth-O-Meter on the days following debates or periods of political grandstanding to see who is really telling the truth and whose pants are on fire.

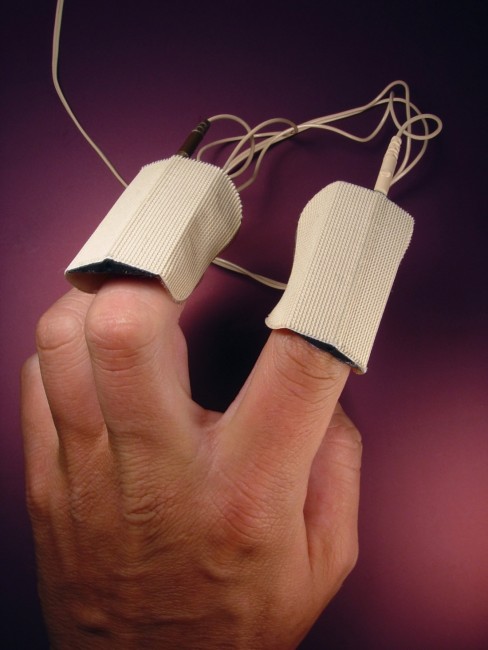

Since we’re all human – yes, politicians are, too – some of us admittedly engage in the occasional white lie or embellishment in the work place. While we don’t have PolitiFact to fact-check our boardroom meetings, one employee recently alleged that his CEO tried to snuff out lies using a portable lie detecting machine.

-

Read more

Read moreFacebook is as public a forum as they come, yet it’s ironic how intimate some posts can be, as if the user is thinking out loud for everyone to hear.

Posts can be funny, political, or just plain weird, while others allow us to commiserate, empathize, or laugh out loud as we take that ultimate step of “liking” them. Sometimes liking another person’s thoughts can carry a high cost, especially if those thoughts disparage one’s employer.

Triple Play Sports Bar and Grille, the disparaged party in this example, took issue with the Facebook activity of two of its employees. Employee Vincent Spinella, a cook, “liked” this statement of a former employee:

“Maybe someone should do the owners of Triple Play a favor and buy it from them. They can't even do the tax paperwork correctly!!! Now I OWE money...Wtf!!!!”

Bartender Jillian Sanzone added the comment, “I owe too. Such an asshole.”

Triple Play’s management noticed the online behavior and discharged Spinella and Sanzone for violating company policy relating to prohibited internet activity.

-

Read more

Read moreIn the corporate world, the treats offered to executives can be as sweet as stock incentives and cash bonuses. But the tricks can be as sour as individual liability for wrongdoing and salary disgorgement.

NJ Supreme Court Makes It Easier For Employers To Take Back Executive Salaries

Lately, we’ve been discussing the Yates Memo and the alarms it must be sounding in corporate board rooms across the country. In a similar vein, the New Jersey Supreme Court offered little comfort to spooked executives when it recently decided to broaden the remedies available to employers who seek disgorgement of former high-level employees’ salaries. -

Read more

Read moreThe Justice Department issued a memo to United States attorneys nationwide that might have Wall Street executives shifting nervously in their seats. The memo signifies a new focus as it instructs both civil and criminal prosecutors to pursue individuals, not just their companies, when conducting white collar investigations. According to The New York Times, the memo is a “tacit acknowledgement” that very few executives who played a role in the housing crisis, the financial meltdown, and other corporate scandals have been punished by the Justice Department in recent years. Typically when a company is suspected of wrongdoing, the company settles with the government after supplying the authorities with the results of its own internal investigation. This paradigm has led to corporations paying record penalties, while individuals usually escape criminal prosecution. Deputy U.S. Attorney General Sally Q. Yates authored the memo and articulated the Justice Department’s new resolve. “Corporations can only commit crimes through flesh-and-blood people. It’s only fair that the people who are responsible for committing those crimes be held accountable.” To achieve this end, U.S. attorneys are directed to focus on individuals from the beginning, and will refuse “cooperation credit” to the company if they refuse to provide names and evidence against culpable employees. And don’t think about naming a fall guy to take the blame. Ms. Yates said the Justice Department wants big names in senior positions. “We’re not going to be accepting a company’s cooperation when they just offer up the vice president in charge of going to jail.” We’ll have more on the Yates Memo and its potential implications in weeks to come.

-

Read more

Benjamin Wey immigrated to Oklahoma from China as a teenager with scant dollars in his pocket. He parlayed ambition and ties to Chinese businesses into a lucrative investment firm engaged in the controversial practice of reverse mergers. According to the Washington Post, this so-called “Wolf of Wall Street” hired a beautiful Swedish model, Hanna Bouveng, to serve as his assistant, and used her Swedish contacts to further his business interests while heaping monetary rewards on her to seemingly win her affections. According to Bouveng, Wey pressured her into a sexual relationship, and when she refused his advances, he allegedly terminated her employment, waged war on her reputation through social media, stalked her, and threatened her with further ruin. Ms. Bouveng fought back in Manhattan federal court where she sued Wey for sexual harassment, retaliation and defamation. The jury returned an $18 million verdict in favor of Ms. Bouveng. While Ms. Bouveng likely feels vindicated, Wey is claiming victory on his twitter account.

-

Read more

Read moreWhen Dodd-Frank became law in 2010, companies with corporate compliance programs viewed the whistleblower provisions warily and anticipated a potential negative impact on the success of their own internal reporting programs. According to a Law360 piece authored by Vinson & Elkins partner Amy Riella, some companies feared that employees would circumvent the internal reporting process in favor of taking information directly to the SEC to reap the financial awards. A related fear was that corporate officers would be incentivized to do the same as they learned of misconduct through compliance channels. The SEC sought to allay these concerns by creating implementation regulations that disallowed corporate officers from bringing actions when they learned of the relevant information through the role they played in the compliance process. In other words, the officer would have to learn of the fraudulent activity through his or her own “independent knowledge or independent analysis.” There is an important exception to this rule – an exception that recently earned a former company officer a six-figure award for reporting securities fraud. The exception states that once the company becomes aware of the issue, it has 120 days to address the alleged misconduct. If the company fails to act within the allotted time frame, the door opens for the otherwise ineligible corporate officer to use the second-hand information to become the corporate whistleblower.

Like sands through the hourglass, so are the days of testimony in the Pao/Kleiner Perkins sexism trial. This week’s installment pitted one female venture capitalist against another. Mary Meeker, the top-ranking female partner at Kleiner Perkins, testified to the virtues of Kleiner Perkins and her belief in its fair treatment of women. When gender is a fundamental issue, the testimony of one woman’s experience versus the other can prove pivotal. According to Fortune, Ms. Meeker, a well-known investor who was once dubbed “Queen of the Net,” by Barron’s Magazine, offered a perspective designed to undercut the claims of discrimination advanced by Pao in the previous weeks’ testimony. According to USA Today, Ms. Meeker testified that "Kleiner Perkins is the best place to be a woman in the business." That said, high-ranking women are a minority in the firm and their representation in the senior partnership has remained relatively constant. Kleiner Perkins has seven senior partners, two of whom are women. At the time of Ms. Pao’s termination in October 2012, three of the eleven senior partners were women.

-

Read more

Read moreCraig Watts, a chicken farmer from North Carolina, recently brought a whistleblower complaint against Perdue, claiming that the poultry seller retaliated against him for bringing certain animal welfare claims to light. Mr. Watts owns the farm on which the chickens are raised, but, according to the Government Accountability Project, the terms and conditions of the farm operations are strictly governed by the poultry giant. The Food Integrity Campaign (a program operated by the Government Accountability Project) filed the action on behalf of Mr. Watts, defending his right to speak out about the conditions on the farm, which Watts claims run far “afowl” of Perdue’s marketing claims of “cage-free” and “humanely-raised” chickens. After publicizing the conditions on his farm, Watts was placed on a performance improvement plan and is routinely subjected to surprise audits of his farm.

A former executive at L.A.’s Fashion Institute of Design and Merchandising is seeing red over the school’s termination of her employment, which allegedly came after she demanded more diverse branding in the school’s publications. Tamar Rosenthal filed a civil rights complaint in Los Angeles Superior Court alleging that the school, seemingly interested only in shades of white, opposed her attempts to showcase student diversity on the website and explicitly advised her not to showcase gay, black or non-white students in any school publications. According to My News LA, the complaint further alleged that Ms. Rosenthal’s supervisors created an “ultra-conservative, anti-Arab and anti-Muslim political atmosphere in the school’s front office.”

As the regulatory and business environments in which our clients operate grow increasingly complex, we identify and offer perspectives on significant legal developments affecting businesses, organizations, and individuals. Each post aims to address timely issues and trends by evaluating impactful decisions, sharing observations of key enforcement changes, or distilling best practices drawn from experience. InsightZS also features personal interest pieces about the impact of our legal work in our communities and about associate life at Zuckerman Spaeder.

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.

Contributing Editors

John J. Connolly

Partner

Email | +1 410.949.1149

Andrew N. Goldfarb

Partner

Email | +1 202.778.1822

Sara Alpert Lawson

Partner

Email | +1 410.949.1181

Nicholas M. DiCarlo

Associate

Email | +1 202.778.1835