Show posts for: Civil Litigation

-

Read more

Weather gurus are predicting snow, sleet, and rain for our area over the weekend. Although my kids are hoping for the white fluffy stuff, this amateur prognosticator is predicting a downpour. In keeping with this theme, the week’s biggest employment news is Robinson Cano’s $240 million deal with the Seattle Mariners (who are well accustomed to rainy skies). But our sights here at Suits by Suits are on matters a little less lucrative:

- You still have a chance to win free admission to our Dec. 10 webinar, “Whistleblower Watch: Big Issues in the Latest Whistleblower Cases Under Dodd-Frank, Sarbanes-Oxley, and the Internal Revenue Code.” For more details on this prize, click here.

- The First Circuit affirmed a summary judgment ruling in favor of Strine Printing Company against a former sales representative who claimed that his firing resulted in an “oleaginous mass of perceived wrongs.” The decision addresses a number of employment-related claims, including unjust enrichment, breach of an implied or express employment contract, and misrepresentation.

- We’ve previously covered the exploits of Larry Conners. Despite his year-long non-compete agreement, the St. Louis newsman is headed back to TV – as a pitchman. He’ll be a spokesman for John Beal Roofing.

- Jeff Green of Bloomberg Businessweek brought us the latest trend in executive hiring – the “golden hello.” These are multi-million dollar signing bonuses designed to entice new candidates to join the team. Among them: the $45 million that Zynga paid to entice an industry vet, Don Mattrick. Some are skeptical of the arrangements, noting that they don’t correlate with successful performance.

- A Louisiana appellate court has affirmed the dismissal of a lawsuit by former professors at Louisiana College, writes Charles Huckabee of the Chronicle of Higher Education. The professors claimed that they should have been able to use certain books in teaching classes on religion and values, which were prohibited by the college’s administration. The court refused to intervene on the ground that it was a religious dispute not proper for court involvement.

- Dominic Patton of Deadline Hollywood covered Jeff Kwatinetz’s suit against Prospect Park. The producer and talent manager wants a Los Angeles Superior Court judge to decide whether a noncompete provision in his agreement with Prospect Park can permissibly bar him from competing for five years.

-

Read more

Read moreLASIK eye surgery requires a precise surgeon. If the surgery is unsuccessful, it can result in under- or over-correction, dry eyes, or infection.

LasikPlus of Texas, a Houston eye clinic, recently found out that it should have exercised similar precision when drafting its noncompete agreements. Instead, the Fourteenth Court of Appeals ruled last week that because LasikPlus failed to include required language in its noncompete agreement, one of its doctors can open a competing clinic two miles from its front door. See LasikPlus of Texas, P.C. v. Mattioli, No. 14-12-01155-CV (Tex. Ct. App. Nov. 21, 2013). We suspect there was not a dry eye in the house after that decision.

The covenant at issue in the case was part of LasikPlus’s employment agreement with Dr. Frederico Mattioli. Under the covenant, Dr. Mattioli, for the eighteen months following termination of his employment, could not open a competing clinic within 20 miles or solicit LasikPlus’s clients. Dr. Mattioli could only terminate the agreement with 120 days’ notice, or 30 days’ notice if LasikPlus was already in breach.

In October 2012, Dr. Mattioli told LasikPlus that he would be leaving within the month to start his own practice less than two miles away. LasikPlus sued Dr. Mattioli, seeking an injunction to bar him from opening the practice. The employment agreement expressly entitled LasikPlus to an injunction in these circumstances. Further, if the covenant was deemed unreasonable in scope of time or location, other language allowed the court to reform the covenant and enforce it to the degree it would be reasonable.

Yet Dr. Mattioli still succeeded in defeating LasikPlus’s request for an injunction, because the clinic left out a critical piece of the covenant.

-

Read more

Here's a tip that applies when you're negotiating any contract, although in this case we learn it from a negotiation over a severance contract: it's a rather bad idea to make a material change - like, perhaps, increasing the severance payment from 14 weeks of pay to 104 weeks - and then have the other side sign it, without telling them you inserted that change in their draft.

That tip comes from the Sixth Circuit's decision last week in St. Louis Produce Market v. Hughes. Two other helpful tips come from this case. One, for executives seeking to claim under a severance agreement, is to return any of the company's property if it's a condition precedent to obtaining your severance benefit. The other, for those people and their lawyers, is to not willfully disobey the court's discovery orders if you're litigating over the severance agreement. -

Read more

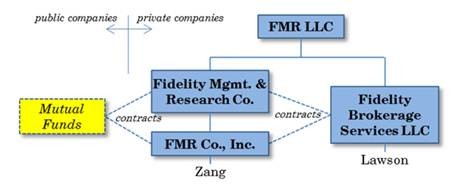

Read moreOn Tuesday, November 12, the Supreme Court will hear argument in the most-watched case of this Term (at least for those of us who edit this blog). The case, Lawson v. FMR LLC, presents the question of whether an employee of a privately-held contractor of a public company can bring a whistleblower retaliation claim against his or her employer under the Sarbanes-Oxley Act of 2002. The plaintiffs in the case, and the parties who have appealed to the Supreme Court, are Jackie Lawson and Jonathan Zang.

In their lawsuit, Lawson and Zang claim that their employers – a group of privately-owned Fidelity subsidiaries that serve as “investment advisers” to publicly-held Fidelity mutual funds – retaliated against them for raising concerns about fraud. Here’s a handy chart from Fidelity’s brief that illustrates the relationship between the parties:

The First Circuit dismissed Lawson and Zang's claims, holding that Sarbanes-Oxley’s anti-retaliation provision only protects employees of public companies. Because Lawson and Zang worked on the blue side of the chart, and not the yellow side, they couldn’t bring a claim for retaliation. (The mutual funds on the yellow side have no employees; they do their business through their contractors on the blue side.)

What do Lawson and Zang argue?

The parties spend a lot of time parsing the language of the Sarbanes-Oxley anti-retaliation provision (18 U.S.C. § 1514A). In their opening and reply briefs, Lawson and Zang argue that the plain text of the law shows that Congress intended to shield employees of contractors of public companies from retaliation for reporting corporate misconduct. If Congress didn’t mean to protect those employees, they say, it wouldn’t have prohibited retaliation by “any officer, employee, contractor, subcontractor, or agent” of “such [public] company.” Under Fidelity’s reading of this provision, the language about contractors would only come into play if a contractor retaliated against a public company employee, and because that doesn’t happen in the real world, the use of the term “contractor [or] subcontractor” would be meaningless.

-

Read more

Read moreIn a decision last week, Judge Ewing Werlein Jr. of the U.S. District Court for the Southern District of Texas addressed the question of whether an employer had successfully alleged a claim under the Computer Fraud and Abuse Act (“CFAA”), such that the employer could properly bring its numerous claims against former employees and their companies in federal court. He ruled that the employer had properly pleaded the CFAA claim, and that as a result, the court had subject matter jurisdiction over the case. Beta Technology, Inc. v. Meyers, Civ. No. H-13-1282, 2013 WL 5602930 (S.D. Tex. Oct. 10, 2013).

Before we get into the substance of the decision, some background is in order. Subject matter jurisdiction is an important issue for federal judges. If there’s no basis for subject matter jurisdiction, a case doesn’t belong in federal court. First-year civil procedure students learn this rule from the venerable decision in Capron v. Van Noorden, in which the Supreme Court allowed a plaintiff to obtain reversal of a final judgment because he hadn’t properly alleged that the court below had subject matter jurisdiction over his claim.

The two main categories for federal jurisdiction in non-criminal cases are diversity jurisdiction and federal question jurisdiction. Diversity jurisdiction, as defined in 28 U.S.C. § 1332, permits the federal courts to hear disputes between citizens of different states – i.e., “diverse” citizens – so long as more than $75,000 is at stake. Federal question jurisdiction, which is defined in 28 U.S.C. § 1331, allows the federal courts to address “all civil actions arising under the Constitution, laws, or treaties of the United States.” And under 28 U.S.C. § 1367, once the court has jurisdiction to hear one claim, it can hear any other claims that form “part of the same case or controversy,” even when those claims drag additional parties into the mix.

-

Read more

Read moreUsually, a plaintiff feels pretty good when he gets the opposing party to sign a settlement agreement promising to pay him money. It’s nice to wrap up a hotly disputed case and move forward with the assurance that you’ll get what is promised under the settlement.

But then there’s the unusual case of Joe Martinez. Martinez was the president of Rocky Mountain Bank before the bank fired him in 2010. His contract entitled him to one year’s base pay ($200k) if he was terminated without cause. However, he didn’t get the money after he was fired, because three months earlier, the Federal Reserve had notified the bank that it was in a “troubled condition” as defined by federal regulations. If a bank’s in a “troubled condition,” under rules established by the Federal Deposit Insurance Corporation, it can’t make a so-called “golden parachute” severance payment.

Martinez quickly sued for the money due under his employment contract, and eventually negotiated a settlement with Rocky Mountain Bank for $100,000. The bank told Martinez that it needed to get approval for the payment from the Federal Reserve. Shortly thereafter, the Federal Reserve told the bank that it couldn’t pay. As a result, Martinez had to ask the district court to enforce the settlement, which it refused to do.

Last week, the Tenth Circuit affirmed the district court’s decision on three grounds. Martinez v. Rocky Mountain Bank, No. 11-8076 (10th Cir. Oct. 4, 2013).

-

Read more

Read moreJoseph Guinn’s case started with a phone call. Leigh Sargent, the president of Applied Composites Engineering (“ACE”), made the call. Randy Sutterfield, an executive at AAR Aircraft Services, Inc. (“AAR”), was on the other end of the line.

The subject of Sargent’s call was Guinn, who at the time was employed by ACE as an airline mechanic, but who had given notice that he intended to leave ACE and join AAR. Sargent told Sutterfield in no uncertain terms that “Guinn was under the terms of a non-compete agreement and that he believed that it was a violation [for] him to come work for [AAR].” Guinn v. Applied Composites Engineering, Inc. (Ind. Ct. App. Sept. 30, 2013). After some more pressure from ACE, and an (un)friendly reminder that ACE was one of AAR’s customers, AAR knuckled under and fired Guinn.

Unsatisfied with this capitulation, ACE sued both AAR and Guinn. It claimed that Guinn had breached his employment agreement by accepting the job with AAR, and that AAR had intentionally induced the breach. Guinn, now without any job at all, didn’t take this lying down. He countersued ACE for interfering with his own contractual relationship with AAR.

-

Read more

Read moreLast week, the Virginia Supreme Court reversed a trial court’s ruling that a non-compete agreement was unenforceable on its face as a matter of law. The VSC held that the trial court should not have decided the enforceability of the agreement on a demurrer (more about what that means below) because, in Virginia, whether a non-compete is enforceable (or valid) turns on whether it is “reasonable under the particular circumstances of the case” – that is, whether it is “narrowly drawn to protect the employer’s legitimate business interest, is not unduly burdensome on the employee’s ability to earn a living, and is not against public policy.” According to the VSC, this means that the particular circumstances of the case matter, and that the enforceability of a non-compete should not be decided “in a factual vacuum.”

-

Read more

Read moreWhen Yu-Hsing Tu worked at pharmaceutical company UCB Manufacturing, he signed a strict confidentiality agreement. In the agreement, Tu promised that he would never disclose any of UCB's “secret or confidential information,” including a laundry list of items such as “designs, formulas, processes, . . . techniques, know how, improvements, [and] inventions.” Tu's work was important to UCB: he helped formulate its cough syrup products, including Delsym, and had significant knowledge of its “Pennkinetic system” for controlled release of cough medication in liquid form.

In 2001, Tu left UCB and started working for his friend Ketan Mehta at Tris Pharma. Soon after, Tu and Tris Pharma began formulating generic versions of UCB’s cough syrups. Six years later, Tris's competitive products were on the market, and UCB lost a lot of market share.

UCB immediately went to court and sued Tu and Tris for misappropriation of trade secrets, breach of contract, and unfair competition. It asked for a preliminary injunction -- a court order early in the lawsuit that would require Tris to stop using its trade secrets until the merits were finally decided. After a five-day hearing focused on the misappropriation claim, the trial judge denied the injunction, maintaining the status quo for Tris.

Shortly after that win, Tu and Tris took the offensive in the litigation, moving for summary judgment. At that point, UCB made a decision that would end up costing it later on: it voluntarily gave up its claim for misappropriation of trade secrets. The trial court then granted Tu and Tris’s motion for summary judgment on the other claims, relying on its finding during the preliminary injunction phase that Tu and Mehta were credible when they testified that they didn’t misuse UCB’s confidential info. UCB appealed.

-

Read more

There’s been another important development in the legal landscape with respect to age discrimination cases, as last week a federal district court in Oklahoma ruled that the EEOC could proceed to trial on behalf of an employee who alleges that she was terminated by her employer for being “old and ugly.” Equal Employment Opportunity Commission v. Kanbar Property Mgmt., LLC, Case No. 12-CV-00422-JED-TLW (Aug. 23, 2013). (Although similar factually, this is a different lawsuit than the “you’re not that pretty” case discussed by our colleague Bill Schreiner last week, which survived a motion to dismiss.)

If you’re not an employment lawyer, this might strike you as the proverbial “dog bites man” headline. After all, if you can't be fired for being old, certainly you can't be fired for being old and ugly, right? Right?

Well, as it turns out, the law isn’t quite so straightforward. Read on….

As the regulatory and business environments in which our clients operate grow increasingly complex, we identify and offer perspectives on significant legal developments affecting businesses, organizations, and individuals. Each post aims to address timely issues and trends by evaluating impactful decisions, sharing observations of key enforcement changes, or distilling best practices drawn from experience. InsightZS also features personal interest pieces about the impact of our legal work in our communities and about associate life at Zuckerman Spaeder.

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.

Contributing Editors

John J. Connolly

Partner

Email | +1 410.949.1149

Andrew N. Goldfarb

Partner

Email | +1 202.778.1822

Sara Alpert Lawson

Partner

Email | +1 410.949.1181

Nicholas M. DiCarlo

Associate

Email | +1 202.778.1835