-

Read more

Read moreOnce known for her frying, Paula Deen is now known for her firing. On Sunday, the Food Network announced that it would not be renewing Deen’s contract. Public debate has followed about whether Deen’s deposition testimony last month that she used the N-word in the past justified the network’s action. That’s a business decision for the network, not a legal question. However, the lawsuit that Deen was testifying in is chock-full of legal questions of the kind that fascinate us at Suits by Suits – starting with questions of ratification, or when an employer can be held liable for the intentional wrongdoing of one employee towards another employee. Deen’s testimony is relevant to these questions.

-

Read more

Read moreYou’re gonna be interested in this week’s Suits by Suits news – I guarantee it:

- Wednesday’s controversial dismissal of George Zimmer, Men’s Wearhouse pitchman and founder, sent reporters into a tizzy as they competed to come up with the best lead. Tiffany Hsu of the LA Times is the early leader in the clubhouse, starting her article with “The one thing George Zimmer couldn't guarantee was his job at Men's Wearhouse.” Other candidates: Gary Strauss of USA Today (“Men's Wearhouse no longer likes the way George Zimmer looks.”) and Michael Smith of the Deseret News (“He's not going to like the way this looks. I guarantee it.”).

- The Harvard Law School Forum on Corporate Governance and Financial Regulation offered this interesting take on whether attorneys can be Dodd-Frank whistleblowers, from Lawrence West of Latham & Watkins. The main point: the SEC accepts that attorneys can blow the whistle and disclose client confidences in some limited circumstances, although state ethics rules about maintaining those confidences also will come into play.

- Joe Davidson of the Washington Post covered the whistleblower implications of Edward Snowden’s disclosures about NSA surveillance programs. Davidson explained that national security contractors are missing the protections and normal reporting channels that are present for most federal employees who want to blow the whistle on waste, fraud, and abuse. Of course, even those channels don’t permit a whistleblower to take classified info to the press, wrote Pete Williams of NBC News.

-

Read more

Another fun week here at our headquarters in Washington, D. C., where a predicted large storm turned out to be mainly a bust, leaving forecasters to debate why. Here, though, are a few items that without debate are of interest:

- Johnson & Johnson won at the First Circuit Court of Appeals, which affirmed a lower court’s dismissal of a whistleblower’s suit. The whistleblower had alleged J&J was paying kickbacks, but was unable to prove those allegations through discovery during the suit, and the appellate court held that the trial court’s limits on discovery were legitimate.

- Staying in the whistleblower theme, the U. S. Department of Labor agreed to pay an alleged whistleblower $820,000 this week, following a 2012 court finding that Labor – ironically enough – created a hostile work environment and tampered with the long-time employee’s leave balances.

- But whistleblower claims have their ups and downs – like the elevator inspection business. This week, the D. C. Circuit Court of Appeals held that a zealous inspector could not muster enough support for his claim that his supervisors retaliated against him after he complained that his employer, the District of Columbia’s department that regulates and inspects elevators, wasn’t being thorough enough in its task.

- And finally, here’s a colorful dispute we’ll keep an eye on between Larry Connors, a former anchor at KMOV-TV in St. Louis, and the station. Connors was fired shortly after he claimed that the IRS targeted him for an audit after he did a harsh interview with President Obama. He then filed suit, alleging he was fired without cause in violation of his contract. This week, Connors rejected the station’s offer to resolve his case, saying KMOV’s condition that he not work in the St. Louis broadcasting market was unacceptable. We’ll keep an eye on this one.

-

Read more

Read moreWhen a business adopts a company-wide bonus plan and gives itself discretion to administer it, can an executive bring a breach of contract claim challenging the exercise of that discretion? According to the U.S. Court of Appeals for the First Circuit’s decision last week in Weiss v. DHL Express, Inc., the answer is no.

Jeremy Weiss was a director of national accounts for DHL. In 2007, DHL told Weiss that it had selected him to participate in its “Commitment to Success Bonus Plan.” Under the plan, Weiss would receive a $60,000 bonus if he stayed with the company through 2009, and another $20,000 bonus if the company met its objectives in that year. There was a catch, however: the plan documents gave DHL’s Employment Benefits Committee the “full power and discretionary authority” to administer the plan, and its decisions would be “final and binding” on the participants.

In October 2008, DHL amended the plan, making all $80,000 of the bonus contingent on Weiss’s continued employment, with an installment of $20,000 in January 2009 and the remainder in January 2010. If Weiss was terminated “without cause,” he would still get the money; if terminated for “good cause,” he would not receive it. DHL paid Weiss the first $20k – however, when it terminated him in September 2009, it refused to pay the remaining $60,000, saying that he had been terminated for “good cause” as the result of failing to supervise his subordinates’ billing practices.

Weiss sued for the rest of the money, and the case proceeded to trial on his breach of contract claim.

-

Read more

As you probably know by now, we here at Suits by Suits have been tracking the rapid developments in state law governing the interpretation and enforceability of covenants not to compete contained in employment agreements. (Our most recent posts on the subject are here and here.) Generally, the theme at the state level has been towards restricting the scope and enforceability of such clauses; be it California’s decision to essentially prohibit all such noncompete provisions, or Massachusetts’s more nuanced attempt to narrow the scope of noncompete clauses by statute.

Today, however, we look at how the private sector – specifically, international consumer electronics retailer Best Buy – has struck back. Read on....

-

Read more

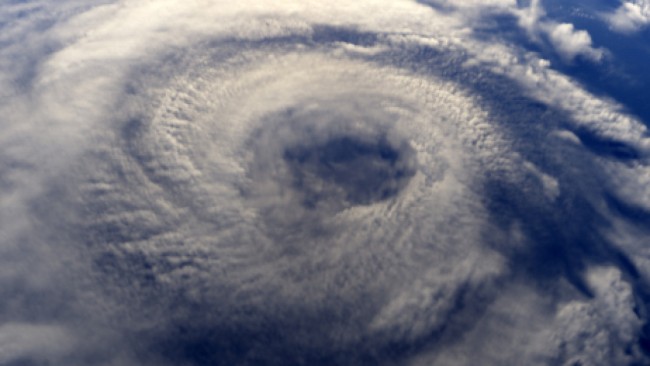

Read moreLet’s just be clear about one thing today. Our great colleagues in Tampa may be used to hurricanes and tropical storms all the time. But for those of us in Zuckerman Spaeder’s Washington, Baltimore, and New York offices, it’s far too early to have to deal with the “remnants of Hurricane Andrea” that are passing overhead today.

Or maybe we’re just a little bummed that the Nats have fallen below .500.

In any event, there’s been a lot of interesting stuff in The Inbox – take a look below:

The judges in this one won’t be sitting in the balcony: A film editor on Walt Disney’s Muppets movie has sued the company, alleging it failed to protect her from racial and gender discrimination.

Employment agreements cross into Canada just like, uh, whatever we export to them any more: An interesting piece on a decision by a court in British Columbia, holding that an employee of both Verizon and its Canadian subsidiary was entitled to receive notice in advance of her termination under Canadian law.

Do you want a non-compete with that flat screen: Best Buy, according to the Minneapolis Star-Tribune, is expanding its use of non-compete agreements beyond the C-Suite. Under the new plan, vice-presidents who want to be eligible for the electronics retailer’s stock bonus plan will need to agree not to work for a competitor for a year after leaving the company.

“And you should see how quick he is with the collection plate”: Two former teachers at a California religious school claim in their suit against the school that they were fired for failing to provide “pastoral reference letters” and for refusing to go to spiritual counseling. They allege religious discrimination, wrongful termination, and retaliation under California law, and seek compensatory and punitive damages.

From the “unusual job requirements” department: Staying in the explosive zone of religion and the workplace, this is a great story from Courthouse News about an urban planner in Tybee Island, Georgia – a nice-looking resort town on the Georgia coast where you can rent Southern chef Paula Deen’s personal vacation home -- who alleges he was fired because he: 1) wasn’t Episcopalian – he was Mormon – and refused his supervisor’s suggestion he go to an Episcopalian church to “fit in” with the community; 2) refused her suggestion that he go drink at the local bar, Hucapoos, also to fit in; and 3) refused her suggestion that he fit in by playing bingo and other card games.

And that’s three: The excellent Blog of the Legal Times reports that Booz Allen Hamilton now faces a third gender discrimination suit by a former principal in its legal department. Carla Calobrisi says she was demoted, subject to a glass ceiling that wouldn’t allow women over forty to advance, and ultimately forced to resign; the consulting firm calls her suit “curious” because she voluntarily resigned, it claims, over two years ago.

-

Read more

Read moreAmerican Airlines’ CEO, Tom Horton, moved one step closer to receiving the $20 million severance payment he’s negotiated with the bankrupt airline. On Tuesday, the bankruptcy judge hearing American’s case allowed the payment to stay in the airline’s disclosure statement (approval of the statement is a predicate step to ultimately “reorganizing” and exiting bankruptcy). The approval comes over strenuous objections by the U. S. Trustee, who argued that Horton’s payment violated bankruptcy law. The judge’s decision isn’t final, and the issue can be revisited down the road, but the fact that it stayed in the disclosure statement (and will be presented to the airlines’ creditors for approval) is one more hurdle cleared for Horton.

We’ve written about this payment here, here, and here. And, no, we don’t write about it so much because we’re jealous of the substantial payment Horton may receive; it’s what this case says about severance and golden parachutes generally. Although the lifetime of free travel he and his wife would also receive under his severance agreement is, frankly, kind of cool.

-

Read more

Read moreNon-Compete In Employment Agreement Enforceable Even If It Wasn’t Mentioned In Offer Letter

Non-competes – those contractual agreements that, when enforceable (and enforced) can keep an executive from leaving one job for a job with a competitor – are frequent topics here at Suits-by-Suits, almost as common as the Brood II cicadas were supposed to be here in our home base of Washington, D.C.

So, a story on non-competes is not unique for us, but this one has a twist. It raises an unusual enforcement question: does a non-compete have to be included in both an offer letter and an employment agreement, or is including it in the agreement alone – and conditioning the offer of employment on signing that agreement – enough to make it enforceable?

Last week, the Pennsylvania Supreme Court held that it’s the final employment agreement that matters, and if the non-compete clause is in the final agreement, then it doesn’t matter if the clause was in the offer letter or not.

-

Read more

Read moreWe have had an ongoing conversation at Suits by Suits about the rapid proliferation of mandatory arbitration clauses in employment contracts, from the top of the company on down. In April, we noted that one of employees’ chief strategies in trying to defeat a mandatory arbitration clause is to argue that the clause is unfair or, in legalese, “unconscionable.” If an arbitration provision is drastically unfair to the employee, a court can strike it down under the doctrine of “unconscionability,” which permits a court to throw out a contractual provision that is so one-sided as to be “shocking to the conscience.”

The thing is, what is palatable under state law in one place may shock the conscience under state law in a different state.

-

Read more

Read more2013 has been a banner year for followers of the Sarbanes-Oxley whistleblower protection provision, 18 U.S.C. § 1514A. As we’ve previously discussed on Suits by Suits, the Supreme Court will decide in its next term whether Sarbanes-Oxley protects employees of privately-owned corporations, in Lawson v. FMR, LLC. The Third Circuit also recently held, in Wiest v. Lynch, that an employee does not have to allege that he “definitively and specifically” reported a known legal violation in order to state a Sarbanes-Oxley claim.

Most recently, on Tuesday, the Tenth Circuit held that an employee is protected under Sarbanes-Oxley for reporting misconduct even when the misconduct does not involve a fraud against shareholders (Lockheed Martin Corp. v. Administrative Review Board, Department of Labor).

The facts of Lockheed involve tawdry letters, military affairs, and humiliation in the workplace.

As the regulatory and business environments in which our clients operate grow increasingly complex, we identify and offer perspectives on significant legal developments affecting businesses, organizations, and individuals. Each post aims to address timely issues and trends by evaluating impactful decisions, sharing observations of key enforcement changes, or distilling best practices drawn from experience. InsightZS also features personal interest pieces about the impact of our legal work in our communities and about associate life at Zuckerman Spaeder.

Information provided on InsightZS should not be considered legal advice and expressed views are those of the authors alone. Readers should seek specific legal guidance before acting in any particular circumstance.

Contributing Editors

John J. Connolly

Partner

Email | +1 410.949.1149

Andrew N. Goldfarb

Partner

Email | +1 202.778.1822

Sara Alpert Lawson

Partner

Email | +1 410.949.1181

Nicholas M. DiCarlo

Associate

Email | +1 202.778.1835